Gst Payment Jan 2024 Due Date. Important due dates for the gst returns in the month of january, 2024. This article provides an organized compilation of the due dates for compliance related to gst, income tax, esi, pf acts, and fema.

Important due dates for the gst returns in the month of january, 2024. · the filling is suspended currently for both gstr 2 and gstr 3 forms.

Gst Payment Jan 2024 Due Date Images References :

Source: annyqjoline.pages.dev

Source: annyqjoline.pages.dev

Gst Payment Dates 2024 Natty Viviana, · the filling is suspended currently for both gstr 2 and gstr 3 forms.

Source: nikiqnickie.pages.dev

Source: nikiqnickie.pages.dev

940 Due Dates 2024 Tonye, Stay compliant in january 2024 with our comprehensive guide on income tax, gst, and labour law due dates.

Source: gertrudwolive.pages.dev

Source: gertrudwolive.pages.dev

Gst Cheque Dates 2024 Darb Minnie, Navigating the landscape of goods and services tax (gst) can be a complex endeavor for businesses, with timely compliance of paramount importance.

Source: nonnadarrelle.pages.dev

Source: nonnadarrelle.pages.dev

2024 Gst Dates Nevsa Othilia, It is important to ensure that a valid gstin is provided.

Source: cleartax.in

Source: cleartax.in

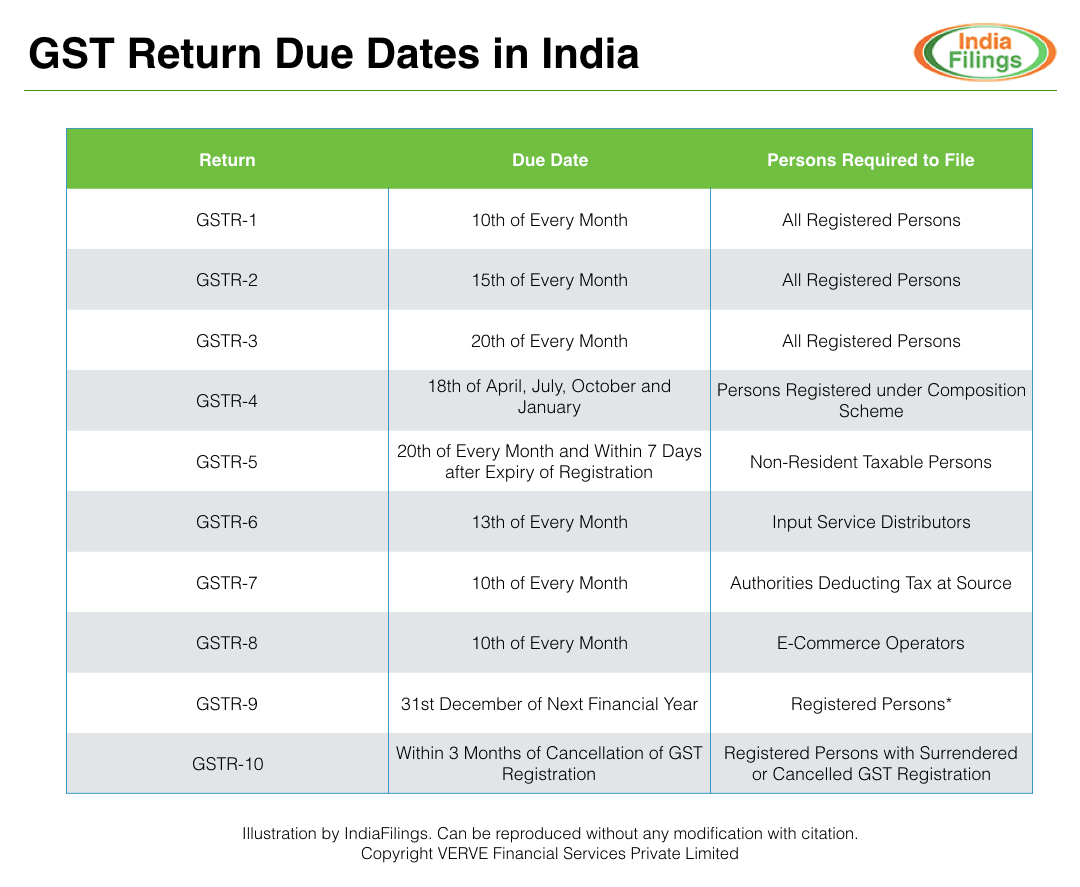

Types and forms of GST Returns and their Due Dates, Stay compliant in january 2024 with our comprehensive guide on income tax, gst, and labour law due dates.

Source: www.indiafilings.com

Source: www.indiafilings.com

GST Return Due Date Important Dates of GST return filing IndiaFiling, This article provides a detailed breakdown of the gst returns due in september 2024, covering monthly and quarterly filings for different taxpayer categories.

Source: duttonlaw.ca

Source: duttonlaw.ca

GST Payment Dates In Canada In 2024 Dutton Employment Law, · the filling is suspended currently for both gstr 2 and gstr 3 forms.

Source: dailyeconomicbuzz.com

Source: dailyeconomicbuzz.com

GST/HST Credit Dates 2024 When Will You Receive Your GST/HST Credit, This article provides an organized compilation of the due dates for compliance related to gst, income tax, esi, pf acts, and fema.

Source: www.nalandaopenuniversity.com

Source: www.nalandaopenuniversity.com

GST & HST Payment Dates 2024 Canada Payment Due Date, This article provides an organized compilation of the due dates for compliance related to gst, income tax, esi, pf acts, and fema.

Source: cemca.org.in

Source: cemca.org.in

GST & HST Payment Dates 2024 Canada Payment Due Date, Navigating the landscape of goods and services tax (gst) can be a complex endeavor for businesses, with timely compliance of paramount importance.